ESG Ratings: Chaos Creators or a Framework for Optimizing Sustainable Investments?

Why ESG Ratings Emerged

To help investors assess corporate sustainability performance, a broad market for ESG ratings has developed. Despite limited comparability, these ratings provide an initial evaluation of a company’s ESG quality and serve as a useful orientation—especially in increasingly complex markets for sustainable investments.

Apples and Oranges: Why Ratings Are Hard to Compare

Direct comparisons between agencies are often of limited value. Different assessment approaches, methodologies, and weightings lead to significant discrepancies:

- Different approaches: For example, Sustainalytics primarily evaluates sustainability risks, while other providers focus more on a company’s impact.

- Varying topics and indicators: The ESG issues considered in the evaluation differ between agencies.

- Diverse measurement methods & weightings: Indicators are collected and weighted differently, affecting the overall score.

Conclusion: Creating a universal “best ranking” across all agencies is methodologically challenging. It is more effective to understand the logic of each rating and relate it to your own goals.

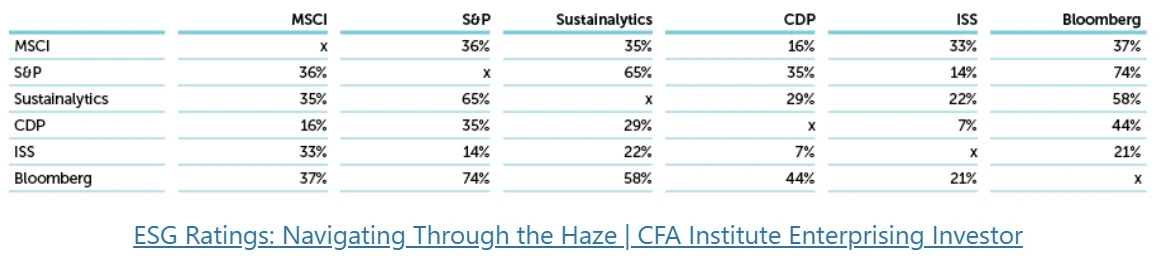

“Seriously Flawed?” – How Strongly Ratings Differ

A study by the CFA Institute shows a low correlation between the ratings of major providers—from 0.65 (e.g., between S&P Global and Sustainalytics) to as low as 0.14 (between ISS and S&P Global).

Implications for investors: Depending on the chosen agency, they may receive different assessments of a company’s sustainability performance.

Do ESG Ratings Still Drive Sustainability Forward?

Despite the lack of standardization, ESG ratings provide practical guidance. They help identify leaders and laggards and are increasingly relevant for SMEs:

- Lending practices: Mid-market banks increasingly consider ESG ratings. Poor ratings can lead to higher financing costs.

- Capital flows: The focus on higher-rated companies redirects capital—positively impacting overall sustainability performance.

Practical effect: Many agencies primarily assess publicly available information, such as websites or CSR/sustainability reports. This means ratings can be improved in the short term by providing complete and easily accessible publications. In the long term, however, concrete ESG initiatives and robust sustainability management are essential.

What to Do? A Pragmatic Approach to ESG Ratings

ESG Leaders Should Prioritize:

- Identify relevant providers: Which ratings have the highest reputation among investors in your industry?

- Understand and integrate criteria: Consider rating requirements in strategy, actions, and communication.

- Increase transparency: Provide data, KPIs, and policies consistently and accessibly (website, reports, policies).

- Short-term vs. long-term: Optimize publications while strengthening ESG programs to improve ratings sustainably.

Our Offering: With experience in ESG management, reporting, and targeted communication, we support companies in maximizing the potential of ESG ratings.

For questions about implementing, optimizing, or enhancing your sustainability efforts and communication, the ESG team at Silvester Group is happy to assist.

Contact us for more information.