New ESMA guidelines for ESG fund names: uniform rules against greenwashing

Transparency is becoming increasingly important in the debate on sustainable investments. Particularly in the case of funds that describe themselves as ‘sustainable’, “green” or ‘social’, the question is being asked more and more frequently: how credible is this? In May 2024, the European Securities and Markets Authority (ESMA) therefore published uniform rules across Europe designed to prevent funds from engaging in greenwashing – i.e. presenting themselves as more sustainable than they actually are – by using misleading terms.

To achieve this, ESMA has defined guidelines for the use of sustainability terms in fund names. These rules primarily affect fund providers, but are also relevant for investors, as they will enable them to more clearly recognise what the fund names really mean in future.

Definitions:

- ESMA: European Securities and Markets Authority

- BaFin: Federal Financial Supervisory Authority

- ESG: Environmental, Social, Governance

- CTB: Climate Transition Benchmark – EU standard for climate transition investments with minimum requirements

- PAB: Paris-Aligned Benchmark – EU benchmark with stricter exclusion criteria in line with the Paris climate targets

- SFDR: Sustainable Finance Disclosure Regulation – EU regulation on disclosure requirements for sustainable financial products

ESMA guidelines on fund names: Uniform rules for sustainable funds in the EU

New ESMA guidelines for fund names: What does this mean for asset managers? BaFin will apply the new European ESG requirements without restriction. Three categories of terms – three sets of rules: From “transition” to “sustainable”, clear investment strategies, exclusions and evidence must now follow. Here is an overview of what matters now – and why early action is crucial.

On 14 May 2024, the European Securities and Markets Authority (ESMA) published guidelines setting out clear criteria for the use of ESG and sustainability terms in fund names. These are intended to prevent greenwashing and ensure greater transparency.

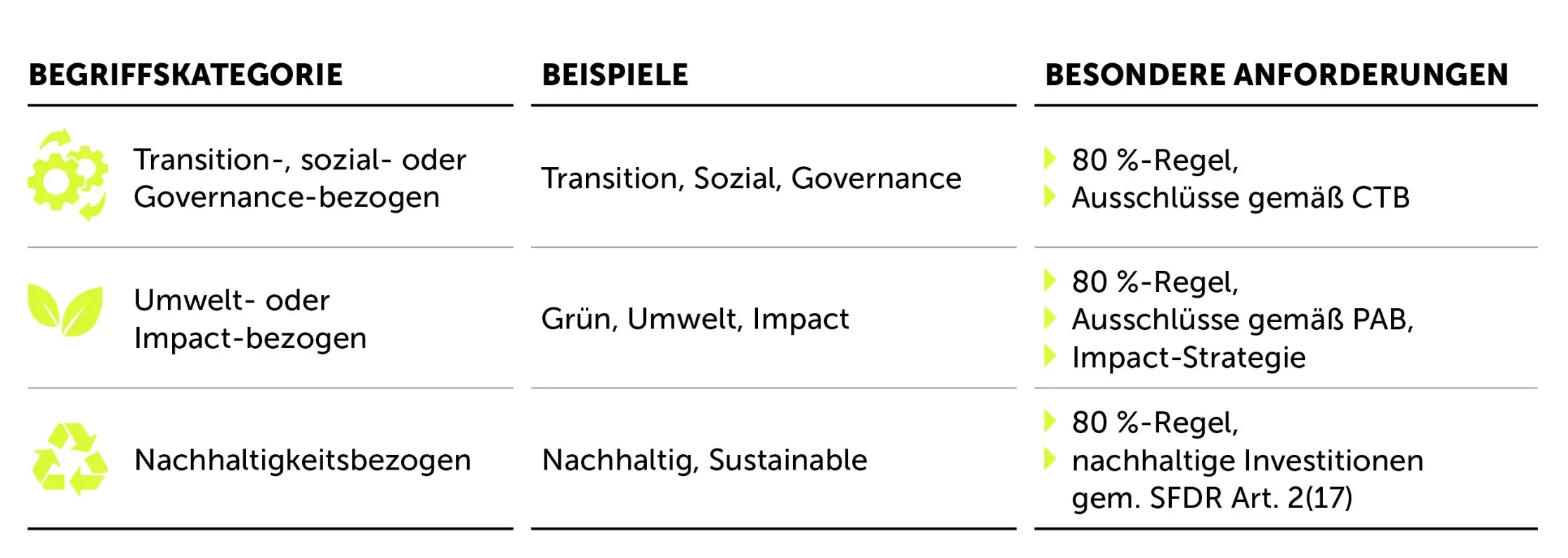

Three groups of terms with specific requirements

ESMA distinguishes between three categories of terms in fund names, to which different requirements apply:

Key points:

- BaFin will apply the guidelines without restriction.

- 21 November 2024: Applicability to new funds.

- 21 May 2025: Deadline for existing funds.

Conclusion:

An important step against greenwashing and towards greater clarity in the ESG sector. Early action is crucial for asset managers.

Quellen:

https://www.bafin.de/SharedDocs/Veroeffentlichungen/DE/Aufsichtsmitteilung/2024/aufsichtsmitteilung_24072024_ESMA_Leitlinien_Fondsnamen.html – https://www.bafin.de/SharedDocs/Veroeffentlichungen/DE/Meldung/2024/Meldung_241001_Fondsnamen_ESMA-Leitlinien.html – https://www.bafin.de/SharedDocs/Veroeffentlichungen/DE/Fachartikel/2024/BaFin-ESMA-Leitlinien-Fondsnamen-Poetzsch.html